EU Reverse Charge

Alf.io supports the Reverse Charge mechanism for EU-based B2B invoices.

Since there’s no general rule about the reverse charge (i.e. each Member State can decide whether or not to apply it), Please check with your accountant if you must apply it or not

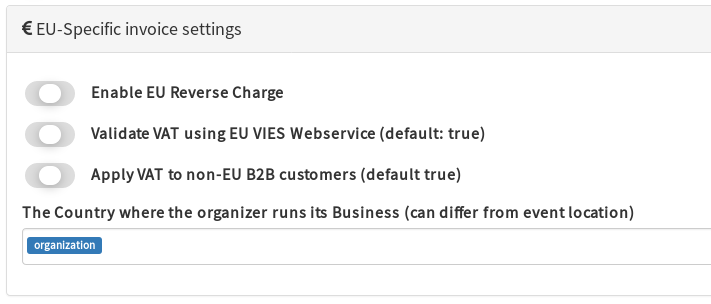

To activate it, head to the Invoice section of your configuration

Enable EU Reverse Charge

default: false

Enable this flag if you want to activate the Reverse Charge mechanism

Validate VAT using EU VIES Webservice

default: true

Controls whether or not to call the VIES Webservice to validate a given EU VAT number

Apply VAT to non-EU B2B customers

default: true

Controls whether or not to apply VAT to non-EU business customers. This regulation is country-specific, please check with your accountant.

The country where the organizer run its business

Select the Country where your business is based. This will be compared with the customer Country to determine if Reverse Charge must be applied.