EU Reverse Charge

How to enable EU Reverse Charge support.

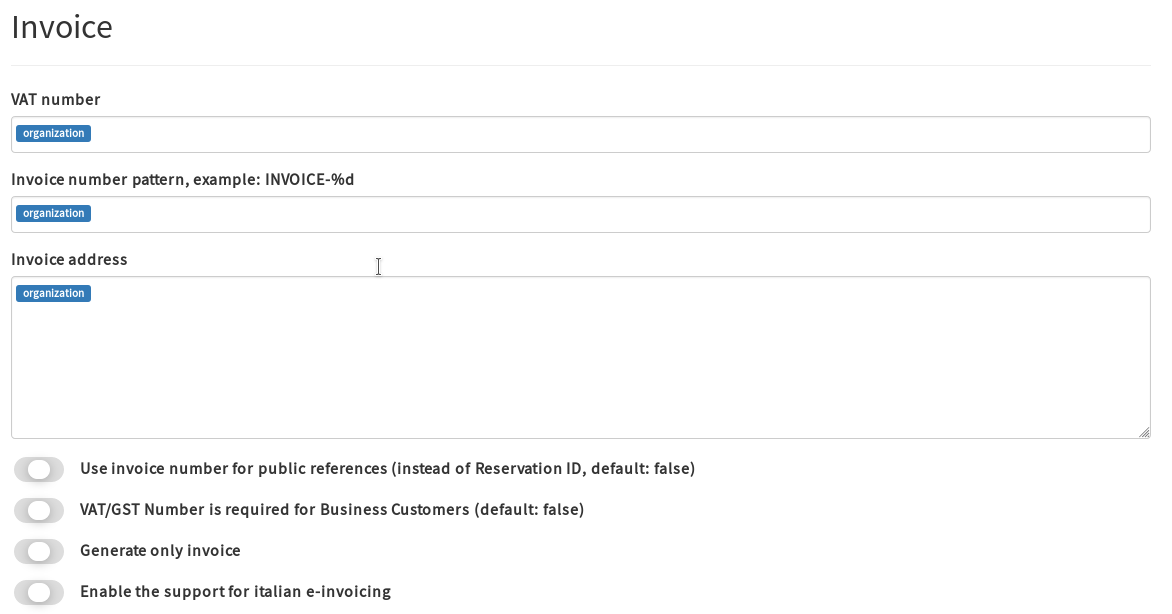

Head to the “Invoice” section of your organization’s configuration

Your Organization’s VAT number - Required

The pattern to apply when generating the invoice number. The default is to increment an organization-based counter.

Here some examples of how you can customize the invoice number:

| Description | Value | Result |

|---|---|---|

| prepend the “INVOICE-” text | INVOICE-%d |

INVOICE-1 |

| append the “-INVOICE” text | %d-INVOICE |

1-INVOICE |

| prepend the “INVOICE-” text, ensure a length of 3 zero-padded | INVOICE-%03d |

INVOICE-001 |

Enter here the address of your Organization, as it should appear on the invoice

Enable this flag if you want to use the invoice number as reference number, instead of the Reservation ID

Enable this flag if you want to force every business customer to enter their TAX ID number.

Enable this flag if you want to generate only invoices. The default is to let the attendee choose whether they want an invoice or a payment receipt.

Enable this flag if your business is based in Italy and you must comply with the E-Invoicing regulation, more here

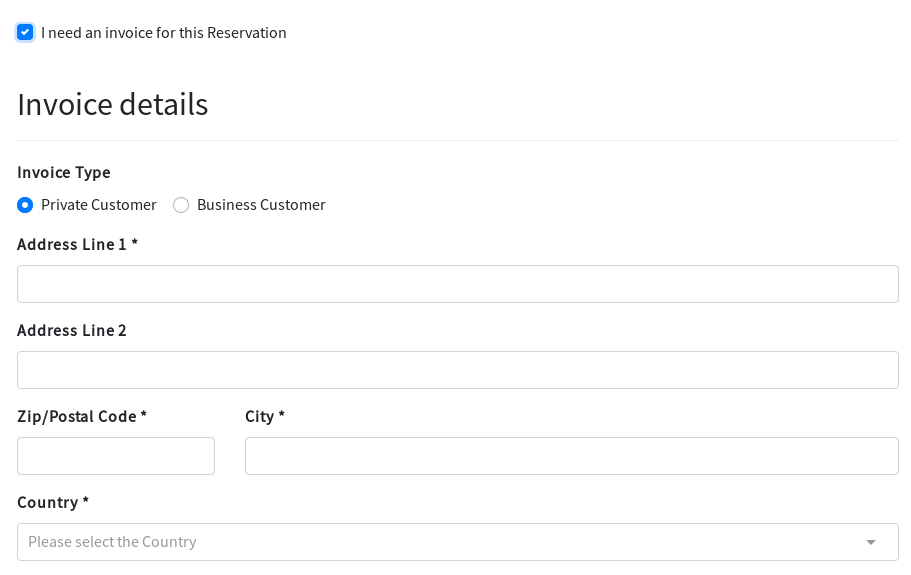

Depending on the value of the Generate only Invoice flag, the customer might have the possibility to choose whether or not they want to generate an invoice:

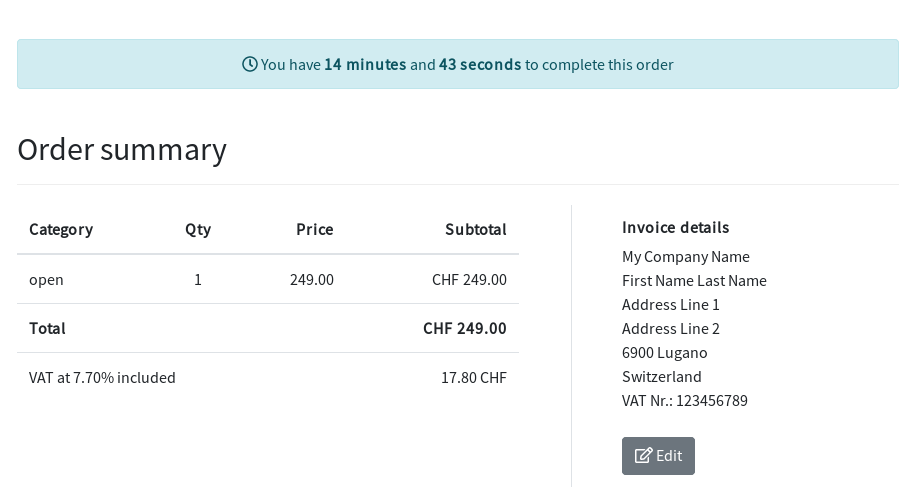

Once they fill up the billing data and confirm, the Invoice Details will be saved

they can check the invoice details and update if needed.

Once the reservation is complete:

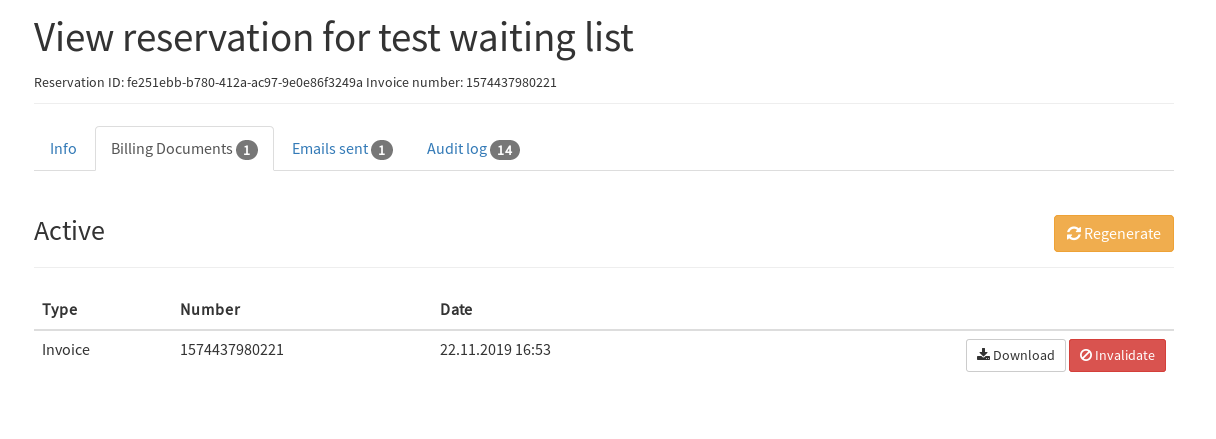

If you want to regenerate/download an invoice for a reservation, head to the Reservation Detail, and click on the “Billing Documents” tab

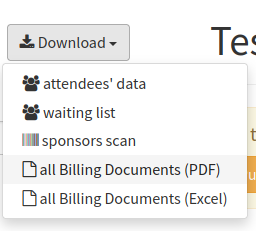

You can download all the invoices generated for an event, by selecting Download -> all Billing Documents on the event detail page

How to enable EU Reverse Charge support.

How to configure alf.io to collect data for Italian E-Invoice.